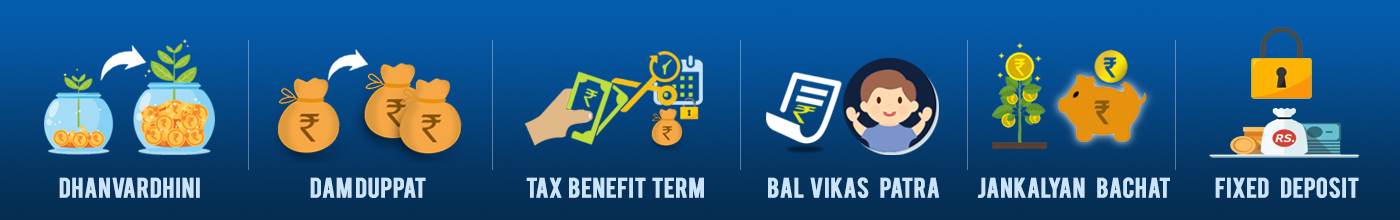

Dam Duppat Yojana

Dam Duppat Yojana

Under the scheme the periodical interest is compounded quarterly and an amount equivalent to double the amount initially deposited by the customer is paid after completion of 96 months.

TDS will be deducted if the amount of interest in a financial year exceeds Rs. 40,000/-. If you do not want to pay TDS you will have to submit Form 15G/H along with a copy of PAN card every year.

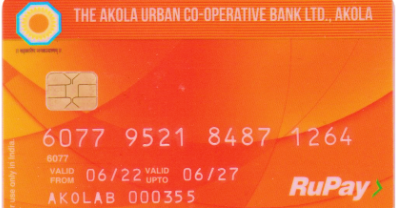

Banking Facility

Disclaimer

The payment to the claimant will be made by the branch where the account exist; after thorough checking of the records by the branch official. If the payment has already been made, the claim by the customer may be rejected.