RTGS, NEFT Facility

The Akola Urban Co-operative Bank has introduced the RTGS / NEFT Funds Transfer Facility.

-

The Akola Urban Co-operative Bank has introduced the RTGS / NEFT Funds Transfer Facility for our esteemed Customers. The general Guidelines for handling the transactions related to RTGS / NEFT are as follows.

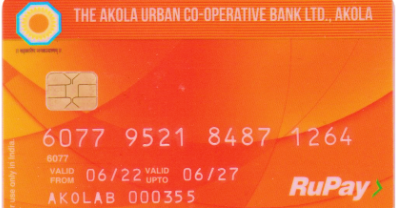

All the RTGS / NEFT transactions will require a Valid Instrument i.e. Cheque.

The Transaction Time for RTGS/NEFT will be from 10:30 AM to 4:30 PM on working days.

Transactions below Rs.2,00,000/- (Rs. Two Lakh Only) will be in NEFT.

Transactions Above Rs.2,00,000/- (Rs. Two Lakh Only) will be in RTGS.

All other Terms & Conditions are mentioned on the overleaf of the RTGS / NEFT Application form.

All Incoming RTGS / NEFT will be automatically credited to Beneficiary Account and will be notified separately.

Sr. |

Amount |

Charges |

|---|---|---|

1 |

Upto Rs.10,000/- |

Rs.2/- |

2 |

Rs.10,001/- UptoRs. 1,00,000/- |

Rs.5/- + G.S.T. * |

3 |

Rs.1,00,001/- Upto Rs.2,00,000/- |

Rs. 10/- + G.S.T. * |

4 |

Rs.2,00,001/- upto Rs.5,00,000/- |

Rs.25/- + G.S.T.* |

5 |

Rs.5,00,001/- & Above |

Rs.50/- + G.S.T.* |

*Note: G.S.T. (Goods Service Tax) is as per current prevailing rate of 18% w.e.f. 01.07.2017, may vary accordingly.

Banking Facility

Disclaimer

The payment to the claimant will be made by the branch where the account exist; after thorough checking of the records by the branch official. If the payment has already been made, the claim by the customer may be rejected.