Mobile Banking

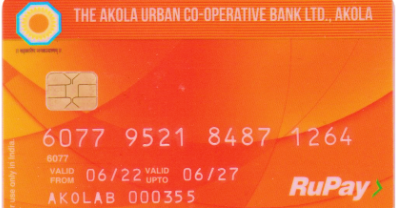

Mobile Application of The Akola Urban Co-operative Bank Ltd., Akola. This Application is made avaliable to all the customer of the bank who have subscribed for all the Services. Customer should visit their nearest Branch and apply for the mobile banking services. Upon Successful registration customers are requested to login in the Mobile Banking App with the user ID and Password that they have received on their registered Email/Mobile Number.

We Provide Below mention functionality in Mobile Banking Application

- Account Summary

- Account Balance

- Account Statement View/Download

- Own Accounts Fund Transfer

- Other Account Fund Transfer

- RTGS / NEFT

- Chequebook Request

- And Many More Services

Click on below Link to Download Akola Urban Mobile Banking Application

1. Open ‘Settings’ on your Android device

2. Scroll down and tap on ‘Developer options’

3. Scroll down to find ‘USB debugging’ and toggle it off to disable it

4. If you are prompted with a warning message, read it carefully and tap on ‘OK’ to disable USB debugging

5. Tap on ‘Developer options’, toggle it off to disable it.

If the developer option is ‘Disable’ or if you can’t' find it, follow the below steps:

1. Open ‘Settings’ on your Android device

2. Scroll down and find ‘About device’ > Version > Build number

3. Tap 7 times on ‘Build number options’

4. Open ‘Settings’ on your Android device

5. Scroll down and tap on ‘Developer options’

6. Scroll down to find ‘USB debugging’ and toggle it off to disable it

7. If you are prompted with a warning message, read it carefully and tap on ‘OK’ to disable USB debugging

8. Tap on ‘Developer options’ toggle it off to disable it.

Definitions:

The following words and expressions shall have the corresponding meanings wherever appropriate.

- AUCB shall mean The Akola Urban Co-Operative Bank Ltd., Akola.

- Account shall mean any account at the bank which has been registered for use via AUCB Mobile Banking.

- Application or App shall mean the Bank’s official software for availing/using the Facility which may be downloaded onto the Mobile Phone by the User through authorized software as may be directed by the Bank.

- Bank shall mean The Akola Urban Co-Operative Bank Ltd., Akola.

- Base Branch shall mean the branch where the customer has his primary account.

- Customer shall mean a person above age of 18 years who hold an account in Bank.

- Facility shall mean the Mobile Banking service offered by the Bank allowing the account holder to access information relating to the Account(s) and also use/avail the product and services as may be made available on the various devices/media like mobile phone/tablets by the Bank from time to time and which may include services over App/USSD/WAP or browser/SMS.

- IMPS means Immediate Payment System which is a product offered by NPCI (National Payments Corporation of India) where in AUCB is a direct member for settlement.

- Mobile Phone shall mean the handset and the SIM card along with the accessories and necessary software(s) for the GSM and CDMA phones used by the User for using/availing the Facility.

- mPIN shall mean the Mobile banking Personal Identification Number or Password for accessing the Facility.

- OTP shall mean One Time Password received through SMS or generated on the Mobile Phone through Application while operating the software wherever necessary.

- User refers to the customer(s) of the Bank authorized to operate the Account(s) for whom an application is made available for using the facility in relation to the Account(s).

- WAP means Wireless Application Protocol

Applicability of Terms and Conditions

- By using AUCB Mobile banking facility, the Customer thereby agrees to these Terms and Conditions, which forms the contract between the Customer and the Bank. Mobile banking facility of the Bank shall be governed by such terms and conditions as may be amended by the Bank from time to time. These terms and conditions shall be in addition to and not in derogation of other terms and conditions relating to any account of the Customer and/or the respective product or the service provided by the Bank unless otherwise specifically stated.

The following Business rules will apply to the facility being offered by the Bank:

- The facility will be available to customers having a satisfactory running Savings/ Current/ Cash Credit type account (including LAFDR, Hypothecation, CC etc.) with the Bank.

- Intra-branch mobile banking (24 hours, 7 days & 365 days a year) – meant for fund transfer to same branch accounts of our bank

- Inter-branch mobile banking (24 hours, 7 days & 365 days a year) – meant for fund transfer to other branch accounts of our bank

- RTGS/NEFT (as per time table of RBI) – meant for fund transfer to other bank accounts

- IMPS (Immediate Payment Service) (24 hours, 7 days & 365 days a year) – meant for fund transfer to other bank accounts. * subject to availability of services after approval from RBI/NPCI

- Upper Limit for transactions: The daily upper ceiling per customer shall be Rs.50,000 for fund transfer / payments, payments when the service is used over the application/ WAP.

- Entering wrong mPIN thrice will block the facility. Then customer would be required to re-register for the facility as per the procedure as laid down and as directed by the bank for the same.

- Any change in the business rules of any of the processes will be notified on Bank’s website www.akolaurbanbank.com, which will be construed as sufficient notice to the customer.

Eligibility:

Sr.No |

Type of Account |

Constitution |

Mode Of Operation |

Who is eligible for Mobile Banking |

|---|---|---|---|---|

| 1 | Saving Account | Single | Single | The account holder |

| 2 | Saving Account | Joint | Either or Survivor | As per choice of all account holders. Application to be signed |

| 3 | Saving Account | Joint | Jointly | NOT eligible |

| 4 | Saving Account | Minor | Single | NOT eligible |

| 5 | Current Account | In the name of Self | Single | The Account holder |

| 6 | Current Account | In the name of firm – Single | Single | The Account holder |

| 7 | Current Account | Partnership Firm | Any one partner | The person authorized to operate. All account holders will sign the application. |

| 8 | Current Account | Partnership Firm | Jointly operated | NOT Eligible |

| 9 | Cash Credit Type | In the name of Self | Single | The Account holder |

| 10 | Cash Credit Type | In the name of firm – Single | Single | The Account holder |

| 11 | Cash Credit Type | Partnership Firm | Any one partner | The person authorized to operate. All account holders will sign the application. |

| 12 | Cash Credit Type | Partnership Firm | Jointly operated | NOT Eligible |

- Accounts where mode of operation is “joint” as also accounts in the name of minor below the age of 18 years or where minor is a joint account holder are not eligible for AUCB Mobile Banking.

- Bank reserves the right to reject a Customer’s application for mobile banking facility without assigning any reasons.

- Bank shall suspend the registration of any Customer if the facility has not been accessed by the Customer for three months or more. For reactivating the services, customer have to visit the branch and provide written application for the same.

- If the facility has not been accessed for six months or more, the registration of the Customer will be cancelled. For reactivating the services, customer have to visit the branch and provide written application for the same.

- Customer can request for termination of the facility by filling new form or from the app himself. The Customer shall remain accountable for all the transactions on the designated account made prior to confirmation of any such cancellation request.

- It shall be the Bank’s endeavor to give a reasonable notice for withdrawal or termination of the facility, but the Bank may at its discretion withdraw temporarily or terminate the facility, either wholly or partially, anytime without giving prior notice or without assigning any reason to the Customer.

- The facility may be suspended for any maintenance or repair work for any breakdown in the Hardware/ Software for AUCB mobile banking or any emergency or security reasons without prior notice and bank shall not be responsible if such an action has to be taken for reasons of security or emergency.

- The services offered under the facility will be automatically terminated if the primary account linked for the Mobile Banking Services is closed.

- The Bank may also terminate or suspend the services under the facility without prior notice if the Customer has violated the terms and conditions laid down by the Bank or on the death of the Customer when brought to the notice of the Bank or when prohibited by law or an order by a court or Authority.

Usage of Facility:

By accepting the terms and conditions on the mobile phone while registering for the facility, the customer:

- Agrees to use the AUCB mobile banking facility for financial and non-financial transactions offered by the Bank from time to time.

- Irrevocably authorizes the Bank to debit the Account which have been enabled for AUCB mobile banking for all transactions / services undertaken using mPIN.

- Authorizes the Bank to map the account number, User ID and mobile phone number for the smooth operation of AUCB mobile banking facility offered by the Bank and to preserve the mapping record in its own server or server of any third party and to use such data at its discretion for providing / enhancing further banking/ technology products that it may offer.

- Agrees that customer is aware and accepts that facility offered by the Bank will enable him/ her to access & transact using mPIN within the limit and manner prescribed by the Bank and the transaction being bonafide will not be disputed.

- Agrees that transactions originated using the mobile phone are non-retractable as these are instantaneous / real time.

- Understands and explicitly agrees that Bank has the absolute and unfettered right to revise the prescribed ceilings and also terms and conditions from time to time which will be binding upon him/her.

- Agrees to use the facility on a mobile phone properly and validly registered in his / her name only with the Mobile Service Provider and undertakes to use the facility only through mobile number which has been registered for the facility.

- Agrees that the Bank is authenticating the Customer by his registered mobile phone number and mPIN provided by the Customer and that such authentication would be sufficient for protection of the customer transactions. The customer is solely responsible for maintenance of the secrecy and confidentiality of the mPIN without any liability to the Bank. The Bank at its discretion may adopt other authentication of electronic records and the same will be acceptable and binding on the customer

Miscellaneous

- Customer shall be required to acquaint himself/herself with the process for using the facility and that he/she shall be responsible for any error made while using the facility.

- Bank reserves the right to decide what services may be offered. Additions/ deletions to the services offered under the facility are at its sole discretion.

- The instructions of the Customer shall be effected only after authentication under his/her User ID and mPIN or through any other mode of verification as may be stipulated at the discretion of the Bank.

- While it shall be the endeavor of the Bank to carry out the instructions received from the Customers promptly, it shall not be responsible for the delay / failure in carrying out the instructions due to any reasons whatsoever including failure of operational system or due to any requirement of Law. The Customer expressly authorizes the Bank to access his/her account information required for offering the services under the facility and also to share the information regarding his/ her accounts with the service provider/ third party as may be required to provide the services under the facility.

- The transactional details will be recorded by the Bank and these records will be regarded as conclusive proof of the authenticity and accuracy of transactions

- Customer understands that the Bank may send rejection or cannot process the request messages for the service request(s) sent by the Customer which could not be executed for any reason.

- Bank shall make all reasonable efforts to ensure that the customer information is kept confidential but shall not be responsible for any inadvertent divulgence or leakage of Customer information for reasons beyond its control or by action of any third party without the fault of the Bank.

- Customer expressly authorizes the Bank to carry out all requests/ transactions purporting to have been received from his/her mobile phone and authenticated with his/ her mPIN. All payment transactions or any other requests, initiated from the customer’s mobile phone using his/her mPIN, will be treated as bonafide request and expressly authorizing the Bank to make the payment or execute the request..

- It is the responsibility of the Customer to advise the Bank of any change in his mobile number or loss/ theft of mobile phone by adopting the procedure laid down by the Bank for the purpose.

- Telecom Service provider of the customer may levy charges for each SMS / GPRS and the Bank is not liable for any dispute that may arise between telecom service provider and the Customer

Fee structure for the Facility:

At present, Bank does not charge any fees for offering this Akola Urban App The Bank reserves the right to charge the Customer fees for the use of the services provided under the facility & change the fees structure at its discretion.

Display of such charges on Bank’s website would serve as sufficient notice and the same is binding on the customer.

Accuracy of Information:

- It is the responsibility of the Customer to provide true and correct information to the Bank through the use of the facility or any other method as may be prescribed by the Bank. In case of any discrepancy in information, the Customer agrees and accepts that the Bank will not be in any way responsible for action taken based on the information. The Bank will endeavor to correct the error promptly wherever possible on a best effort basis, if the customer reports such error in information in the prescribed manner by the Bank.

- Customer understands that the Bank will try, to the best of its ability and effort, to provide accurate information and shall not hold the Bank responsible for any errors or omissions that may occur due to reasons beyond the control of the Bank.

- Customer accepts that the Bank shall not be responsible for any errors which may occur in spite of the steps taken by the Bank to ensure the accuracy of the information and shall not have any claim against the Bank in the event of any loss/ damage suffered as a consequence of an inaccurate information provided by the Bank.

- The Customer will be responsible for all transactions, including fraudulent/erroneous transactions made through the use of his/ her mobile phone, SIM card and mPIN, regardless of whether such transactions are in fact entered into or authorized by him/ her or not and the customer will be responsible for the loss/damage, if any suffered.

- The Customer shall take all steps to ensure that his/her mobile phone, password, mPIN, OTP, CVV, Aadhar Card number PAN details, account details is not shared with anyone and shall take immediate action to de-register from AUCB mobile banking application as per procedure laid down in case of misuse/ theft/loss of the mobile phone or SIM card. It is pertinent to note that the Bank Officer or its representative, any agent will not ask the details such as password, mPIN, OTP, CVV, Aadhar Card number PAN details, account details etc and customer is advised not to share the above details over phone to any unknown person. The Bank will not be responsible in any manner for the loss, damage etc. caused on account of failure of observing this condition.

- The Customer will use the services offered under facility using the mPIN in accordance with the procedure as laid down by the Bank from time to time.

- The Customer shall keep the User ID and mPIN confidential and will not disclose these to any other person or will not record them in a way that would compromise the security of the services.

- It will be the responsibility of the Customer to notify the Bank immediately if he/ she suspect the misuse of the mPIN. He will also immediately initiate the necessary steps to change his mPIN.

- If the mobile phone or SIM is lost, the customer must immediately take action to de-register from AUCB mobile banking at base branch of the primary account enabled for AUCB mobile banking.

- The Customer accepts that any valid transaction originating from the User ID and / or registered mobile phone number shall be assumed to have been initiated by the Customer and any transaction authorized by the mPIN is duly and legally authorized by the Customer.

- The Customer shall keep himself/herself updated with regard to any information/ modification relating to the services offered under the facility which would be publicized on the websites and would be responsible for the same.

- The Customer shall be liable for all loss on breach of the Terms and Conditions contained herein or contributed or caused the loss by negligent actions or a failure to advise the Bank immediately about any unauthorized access in the Account.

- The Customer is advised to ensure that proper anti-virus software is used from time to time to remove malware residing in the hand-set.

Disclaimer

The Bank, when acting in good faith, shall be absolved of any liability in case:

- The Bank is unable to receive or execute any of the requests from the Customer or there is loss of information during processing or transmission or any unauthorized access by any other person or breach of confidentiality due to reasons beyond the control of the Bank.

- There is any kind of loss, direct or indirect, incurred by the Customer or any other person due to any failures or lapses in the facility which are beyond the control of the Bank.

- There is any failure or delay in transmitting of information or there is any error or inaccuracy of information or any other consequence arising from any cause beyond the control of the Bank which may include technology failure, mechanical breakdown, power disruption, etc.

- There is any lapse or failure on the part of the service providers or any third party affecting the said facility and that the Bank makes no warranty as to the quality of the service provided by any such service provider. The Bank, its employees, agent or contractors, shall not be liable for and in respect of any loss or damage whether direct, indirect or consequential, including but not limited to loss of revenue, profit, business, contracts, anticipated savings or goodwill, loss of use or value of any equipment including software, whether foreseeable or not, suffered by the Customer or any person howsoever arising from or relating to any delay, interruption, suspension, resolution or error of the Bank in receiving and processing the request and in formulating and returning responses or any failure, delay, interruption, suspension, restriction, or error in transmission of any information or message to and from the telecommunication equipment of the Customer and the network of any service provider and the Bank's system or any breakdown, interruption, suspension or failure of the telecommunication equipment of the Customer, the Bank's system or the network of any service provider and/or any third party who provides such services as is necessary to provide the facility

- The Bank will not be responsible if Bank’s mobile banking application is not compatible with / does not work on the mobile handset of the Customer.

Indemnity:

- In consideration of the Bank providing the facility, the Customer agrees to indemnify and hold the Bank, its directors, officers, employees, agents, service providers, harmless against all actions, claims, demands proceedings, loss, damages, costs, charges and expenses etc. which the Bank may at any time incur, sustain, suffer or be put to as a consequence of or arising out of or in connection with any services provided to the Customer pursuant hereto. The Customer shall indemnify the Bank its directors, officers, employees, agents, service providers, for unauthorized access by any third party to any information / instructions / triggers given by the Customer or breach of confidentiality.

Privacy Policy

- The purpose of this Privacy Policy is to put on record The Akola Urban Co- Operative Bank Ltd., Akola bank’s (AUCB) commitment in ensuring privacy and confidentiality of customer information. In the course of using this Website or products and services offered by AUCB, AUCB may become privy to the personal information of its customer including information that is of confidential nature.

- We may also share your information, without obtaining your prior written consent, with government agencies mandated under the law to obtain information for the purpose of verification of identity, or for prevention, detection, investigation including cyber incidents, prosecution, and punishment of offences, or where disclosure is necessary for compliance of a legal obligation. Any information may be required to be disclosed to any third party by us by an order under the law for the time being in force. The commitment to customers' privacy and confidentiality is clearly evident in the bank’s Security Policy. The information & material on this website is intended for general understanding of AUCB and to help the public to get exposure to information about the Bank and various products and services offered by the Bank. The Bank may, from time to time amend or change any or all clauses of this policy.

Who is covered under this policy?

All natural persons ("Covered Persons"), whose personal information is either collected/ received/ possessed/ stored/ dealt in/ handled by The Akola Urban Co-Operative Bank / who visit the site http://www.akolaurbanbank.com and provide information to The Akola Urban Co-Operative Bank Ltd online, are covered under this Policy.

Information covered by this Policy

This Policy seeks to cover personal information of the Covered Persons provided to The Akola Urban Co-Operative Bank Ltd as also any information collected by the bank server from the visitor’s browser. The ("Information"), i.e. any of the following:

- Personal/private information of the Covered Persons

- Sensitive personal data or information

Definitions used in this policy

"Personal information" means any information that relates to a natural person, which, either directly or indirectly, in combination with other information available or likely to be available with a body corporate, is capable of identifying such person. "Sensitive personal data or information" of a person means such personal information which consists of information relating to:

- Password

- Financial information such as Bank account or credit card or debit card or other payment instrument details;

- Physical, physiological and mental health condition;

- Sexual orientation;

- Medical records and history;

- Biometric information;

Provided that, any information that is freely available or accessible in public domain or furnished under the Right to Information Act, 2005 or any other law for the time being in force shall not be regarded as sensitive personal data or information for these purposes.

The Features of the Policy:

All Information collected shall be used for the relevant lawful purposes connected with various functions or activities of the Bank related to services in which the Concerned Person is interested, and/or to help determine the eligibility of the Concerned Persons for the product/services requested/ applied/ shown interest in and/or to enable Bank the Covered Persons verification and/or process applications, requests, transactions and/or maintain records as per internal/legal/regulatory requirements and shall be used to provide the Concerned Person with the best possible services/products as also to protect interests of The Akola Urban Co-Operative Bank Ltd.

The Information shall not be shared with any external organisation unless the same is necessary to protect the interests of the Bank or to enable The Akola Urban Co-Operative Bank Ltd to provide you services or to enable the completion/compilation of a transaction, credit reporting, or the same is necessary or required pursuant to applicable banking norms or pursuant to the terms and conditions applicable to such Information as agreed to with The Akola Urban Co-Operative Bank Ltd or pursuant to any requirement of law/regulations or any Government/court/other relevant authority’s directions/orders. Needless to add, confidentiality norms as applicable to banks shall be adhered to. The Akola Urban Co-Operative Bank Ltd may also share Information to provide you with superior services and a range of offers.

We may also share your Information, without obtaining your prior written consent, with government agencies mandated under the law to obtain information for the purpose of verification of identity, or for prevention, detection, investigation including cyber incidents, prosecution, and punishment of offences, or where disclosure is necessary for compliance of a legal obligation. Any Information may be required to be disclosed to any third party by us by an order under the law for the time being in force.

In this regard, it may be necessary to disclose the Covered Persons information to one or more agents and contractors of The Akola Urban Co-Operative Bank Ltd and their sub-contractors, but such agents, contractors, and sub-contractors will be required to agree to use the information obtained from The Akola Urban Co-Operative Bank Ltd only for these purposes.

Information provided by you are retained (for later of the) (i) as long as the purposes for which such data were collected continue. Or (ii) for such period so as to satisfy legal, regulatory or accounting requirements or to protect The Akola Urban Co-Operative Bank Ltd's interests.

Please note that the accuracy of the Information provided to us on the Website is essential, among others, to provision of our products and services to you. It is therefore a term and condition governing the access and use of the Website that you undertake to ensure the accuracy and completeness of all Information disclosed, shared, exchanged or otherwise update and notify the Bank via e-mail a Contact-Us of any changes in the Information.

The Covered Persons authorises The Akola Urban Co-Operative Bank Ltd to exchange, share, part with all information related to the details and transaction history of the Covered Persons to its Affiliates / banks / financial institutions / credit bureaus / agencies/participation in any telecommunication or electronic clearing network as may be required by law, customary practice, credit reporting, statistical analysis and credit scoring, verification or risk management or any of the aforesaid purposes and shall not hold The Akola Urban Co-Operative Bank Ltd liable for use or disclosure of this information.

The Covered Persons shall not disclose to any other person, in any manner whatsoever, any information relating to The Akola Urban Co-Operative Bank Ltd or its Affiliates of a confidential nature obtained in the course of availing the services through the website. Failure to comply with this obligation shall be deemed a serious breach of the terms herein and shall entitle The Akola Urban Co-Operative Bank Ltd or its Affiliates to terminate the services, without prejudice to any damages, to which the Covered Persons may be entitled otherwise.

As regards the information collected from visitors of the website online (“visitor”), The Akola Urban Co-Operative Bank Ltd will use the Information to improve the Covered Persons experience on the site and make subsequent offers to the visitor on products which may be of interest to him / her, if so agreed while giving information.

The The Akola Urban Co-Operative Bank Ltd website uses cookies. Cookies are small data files that a website stores on your computer. We use persistent cookies which are permanently placed on your computer to store non-personal (Browser, ISP, OS, Clickstream information etc) and profiling information (age, gender, income etc). While cookies have unique identification nos, personal information (name, a/c no, contact nos etc) SHALL NOT be stored on the cookies.

We will use the information stored in the cookies to improve visitor experience through throwing up relevant content where possible. We will also use the cookies to store visitor preferences to ease visitor navigation on the site.

We may in the future implement encryption of the cookies. The Akola Urban Co-Operative Bank Ltd also may disclose information about you as permitted or required by law. At The Akola Urban Co-Operative Bank Ltd, we value your relationship and will at all times strive to ensure your privacy. The Bank may, from time to time, change this policy.

Banking Facility

Disclaimer

The payment to the claimant will be made by the branch where the account exist; after thorough checking of the records by the branch official. If the payment has already been made, the claim by the customer may be rejected.

GUIDELINES FOR THE USE OF SOCIAL MEDIA

DISCLAIMER FOR THE GENERAL PUBLIC, STAKEHOLDERS, AND CUSTOMERS

Dear Bank’s Customers, Stakeholders & General Public, The Akola Urban Co-operative Bank Ltd, Akola (AUCB) appreciates your interest shown in our page/channel on various social media platforms. The presence on these platforms is designed to inform you about ongoing developments and events regarding The Akola Urban Co-operative Bank Ltd, Akola, its products, and services. We also aim to understand your opinions on our products and services. We are keen to hear from you and appreciate your participation. We kindly request that you respect and maintain the decorum of social media and consider the detailed guidelines below while communicating with us on social media.

1. Introduction

Social Media encompasses various Internet technologies that facilitate the easy sharing of online content, including but not limited to social networks, blogs, videos, photos, wikis, online reviews, and check-ins, among others. There are numerous social channels, networks, and media tools, with Facebook, Twitter, YouTube, and LinkedIn being among the most popular. The Akola Urban Co-operative Bank Ltd, Akola, is currently present on Facebook, Twitter, and YouTube and will soon establish a presence on LinkedIn.

2. Purpose

The purpose of establishing a Social Media policy for the Bank’s Customers, Stakeholders, and the General Public is to:

• Provide guidance when posting comments, ideas, or concerns on social media.

• Outline Do's and Don’ts on Social Media for Bank’s Customers, Stakeholders & General Public.

• Address regulations, legal considerations, and compliance related to the use of social media.

3. Content

3.1 All content posted on Social Media channels is intended to be indicative and informative. Such content does not imply any contractual obligation on the part of the bank. For the most authentic information, please visit the bank’s corporate website at https://akolaurbanbank.com/ or visit your nearest branch.

3.2 The Bank reserves the right to modify information, materials, and content posted on its Social Media channels/ Platforms as needed, without prior notice.

3.3 Sharing the content posted on the bank’s Social Media channels in its original format is permitted. However, no one has the right to use it for monetary purposes, alter, modify, amend, revise, publish, translate, copy, or distribute any part or content posted thereof, or link any other Social Media channels or websites to this page.

3.4 Please refrain from using abusive, obscene, intimidating, discriminatory, defamatory, offensive, threatening, harassing, or improper language targeting specific individuals or groups while communicating with us/others on our page.

3.5 Posting content that may violate any law, public policy, or infringe on the privacy rights of any person is prohibited.

3.6 Posts promoting the sale of products and services by any individual or entity will not be allowed. Individuals/entities making such posts may be blocked from making further posts on the bank’s Social Media platforms at the sole discretion of the Bank.

3.7 No information or opinion provided by the bank or through a third party on the page is intended to constitute legal, tax, securities, or investment advice, or an opinion regarding the appropriateness of any investment, or a solicitation for any product or service.

3.8 The Bank reserves the right to remove comments or posts without notice if they use discriminatory, defamatory, threatening, obscene, intimidating, discriminating, harassing, hateful, improper language, spam, or violate any intellectual property rights, or contain viruses, or are immaterial and unconnected to the topics discussed on our page. Individuals/entities making such posts may be blocked from making further posts on the bank’s Social Media platforms at the sole discretion of the Bank.

3.9 The Bank may delete or request to delete comments/posts that are clearly off-topic, promote services or products, or promote or oppose any political party, person campaigning for elected office, or any ballot proposition.

3.10 Information and material available on the Social Media Platforms, including text, graphics, links, or other items, are provided on an "as is," "as available" basis. No warranty of any kind, implied, express, or statutory is given in conjunction with the information and material.

3.11 While the Bank cannot fully monitor all comments/posts on its Social Media channels, if any comment/post is found to be misleading, offensive, unlawful, infringing third-party rights, or in breach of these terms and conditions, the Bank reserves the right to remove it from its Social Media channels.

3.13 All information posted by the Bank, including but not restricted to brand names, features, color schemes, etc., may be protected by trademarks, copyrights, and other legal measures. Therefore, please do not copy, amend, or use the content posted by us in any manner without prior written permission.

4. Privacy

4.1 The content of all comments/posts is immediately released into the public domain, so please refrain from submitting anything you do not wish to be broadcast to the general public. Any data and information that you post on these Social Media platforms may reside on servers that the Bank does not own or control. Often, the data posted here is available to any and all members of the public as per the Social Media platforms’ policies. Even upon deletion, the data may be archived by the Social Media platform as per their policies.

4.2 Please do not post personal, account-sensitive information such as debit/credit card numbers, PINs, passwords, account numbers, phone numbers, etc. The Bank does not assume liability for any financial and/or other losses, identity/information theft, or any issues resulting from the posting of sensitive/personal information.

4.3 By using our Facebook, Twitter, and other Social Media channels, you also agree to adhere to the respective platform’s Terms and Conditions and prevailing Privacy Policy or any regulatory norms.

5. Third Party Information

5.1 The Bank is not responsible for the content, privacy, or security policies of any external websites or links.

5.2 Any third-party views and opinions in the comments or posts belong solely and exclusively to the user or third party. The Bank neither takes any responsibility for such views nor endorses them. This includes text, images, documents, audio, and videos added, posted, or linked by users or third parties.

5.3 The Bank does not assume any liability for the messages, comments, links, or uploads posted by users on and/or via the bank’s Social Media properties, nor for decisions made by anyone based on messages from third parties. The Bank does not take any responsibility for such messages or comments and will not be liable for any violating content uploaded and/or linked by Social Media website users.

5.4 The Bank does not assume any responsibilities or provide warranties regarding the accuracy, functionality, or performance of any third party’s software that may be utilized in connection with the page. No guarantee is given by the bank regarding the complete security of sending, posting, or uploading any content over the Internet, as such content is subject to possible interception, alteration, or loss.

5.5 The Bank does not endorse advertisements and any content or links provided by Social Media websites on our Social Media channels, and the bank will not be responsible for them. While using this page, you may be provided links to the website (https://akolaurbanbank.com/) or related pages or any other related websites, including those of our group companies, alliance partners, etc., for further information on the products, services, etc. Your use of our website and/or such third-party websites shall be governed by the respective terms and conditions of such websites. The products and services offered by us exclusively or in alliance with third parties shall be governed by the terms and conditions applicable to such products and services.

5.6 Please exercise utmost care and caution while acting upon/commenting on content posted by a third party. The Bank shall in no way be liable for any loss, damages, or legal action incurred by you as a result of acting upon such content.

5.7 All these Guidelines shall be governed and controlled by the laws of India, and any dispute or claim that may arise shall be exclusively decided by a Court of competent jurisdiction in New Delhi.

5.8 “The Akola Urban Co-operative Bank Ltd, Akola” and its logos are trademarks and property of “The Akola Urban Co-operative Bank Ltd, Akola”. Misuse of any intellectual property or any other content displayed herein is strictly prohibited.

6. Queries, Suggestions, Feedback & Complaints

6.1 The Bank welcomes your suggestions/feedback at https://akolaurbanbank.com/suggestions.php.

6.2 We recommend using the link available on the bank’s corporate website - https://akolaurbanbank.com/contact-us.php for the resolution of queries/grievances about the Bank’s products and services. The channels mentioned in the link are secure channels designated by the Bank. Resolving such matters requires customer-sensitive details, which should not be posted on any Social Media platforms due to the risk of information/identity theft/phishing attacks, which may result in financial and other losses to customers.

7. Regulations, Legal, and Compliance

7.1 Communications made via the bank’s Social Media channels will not constitute a legal or official notice to the Bank or any official or employee of the Bank for any purpose.

7.2 Any content that you post on the bank’s Social Media channels shall be deemed and remain the property of the Bank. The Bank shall be free to use such content/information for any purpose without any legal or financial compensation or permission for such usage.

7.3 The Bank reserves its rights to initiate appropriate legal proceedings in the event of any breach/violation of these guidelines/other terms and conditions as specified by the Bank from time to time.

7.4 Under no circumstances shall the bank or any of our affiliates, employees, or representatives be liable to you for any direct or indirect claims or damages arising from any mistakes, inaccuracies, or errors of content, personal injury or property damage of any nature arising from your use and access of our Social Media platforms or entities purporting to represent the Bank. You specifically acknowledge that the bank shall not assume any liability for the content or the offensive, defamatory, or illegal conduct of any third party, and that the risk of damage or harm arising from the foregoing entirely rests with you. The limitation of liability shall apply to the fullest extent permitted by law in the applicable jurisdiction.

7.5 To the extent permitted by applicable law, you agree to indemnify, defend, and hold harmless the Bank, its affiliates, officers, directors, employees, and agents from and against any and all damages, claims, obligations, liabilities, losses, costs, or debts, and expenses (including but not limited to lawyer’s/attorney’s fees) arising from:

(i) your use of and access to our page;

(ii) your violation of any of these Guidelines;

(iii) your violation of any third party right, including without limitation any copyright, proprietary, or right to privacy; or

(iv) any claim that content posted by you caused damage to a third party.

The indemnification obligation contained herein shall survive these Guidelines and your use of our Social Media channels.

7.6 Anyone with the intent to cause or knowledge that they are likely to cause wrongful loss or damage to the brand’s image, destroy, delete, or alter any information residing on the Social Media platform or diminish its value or utility by any means, commits a hack, shall be prosecuted under the Information Technology Act, 2000 [As amended by Information Technology (Amendment) Act 2008], its subsequent amendments, as well as any other statute prescribed by the concerned authorities.

8. Monitoring and Review of Policy

8.1 The bank shall review this policy annually (once a year) to ensure it meets legal requirements and reflects best practices.

8.2 In case of sudden changes in the social media or banking industry, the Bank shall make necessary policy changes urgently.